Algorithmic trading, often referred to as algo trading, is a powerful and automated approach to trading that has gained significant popularity in recent years. It enables traders to execute complex strategies by using pre-defined rules and algorithms. If you’re interested in getting started with algorithmic trading, this step-by-step guide will help you embark on your journey into the exciting world of automated trading.

Step 1: Understand the Basics

Before venturing into an algorithmic trading program, it’s crucial to have a solid understanding of financial markets. Familiarise yourself with key concepts such as market orders, limit orders, trading psychology, risk management, and various asset classes (e.g., stocks, futures, forex, cryptocurrencies). Read books, take online courses, and follow financial news to build your foundational knowledge.

Step 2: Choose Your Asset Class

Selecting the right asset class is a pivotal decision in your algo trading journey. Consider factors such as your interests, expertise, and risk tolerance. Each asset class has its own characteristics and market dynamics. For instance, stocks are often influenced by company-specific news, while forex markets are affected by geopolitical and economic events.

Step 3: Select a Trading Platform

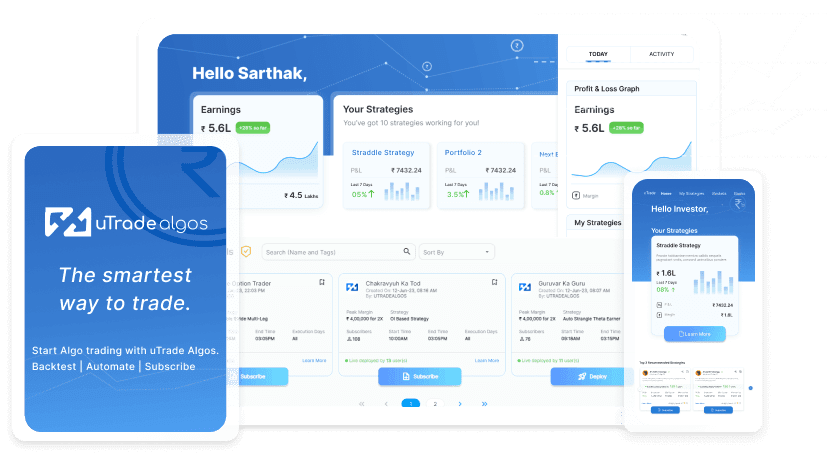

A reliable trading platform is your gateway to algo trading. Popular platforms like Zerodha Streak, uTrade Algos, and Upstox Algo Lab provide a range of tools and resources to facilitate algorithmic trading. Take the time to explore these platforms, understand their functionalities, and choose one that best aligns with your needs and preferences.

Step 4: Learn Programming

Algorithmic trading typically involves some level of programming. The choice of programming language may depend on your chosen platform and your familiarity with coding. Python, for example, is widely used for algorithmic trading due to its simplicity and extensive libraries. If you’re not a programmer, consider enrolling in online courses or hiring a developer to assist with your algorithmic strategies.

Step 5: Develop Your Trading Strategy

Your trading strategy forms the core of your algo trading activities. Define your strategy by outlining specific conditions for entering and exiting trades. Consider elements such as technical indicators, fundamental analysis, or sentiment analysis that your algorithm will use to make trading decisions. Additionally, specify your risk management parameters, including stop-loss and take-profit levels.

Technical Indicators

- Technical indicators are essential components of algorithmic trading strategies.

- Traders use these mathematical calculations to analyse historical price and volume data.

- Moving averages, Relative Strength Index (RSI), Stochastic Oscillator, Bollinger Bands, and MACD are among the commonly employed indicators.

- For instance, a moving average crossover can serve as a signal to buy or sell, while RSI can indicate overbought or oversold conditions.

- These indicators provide quantitative insights into asset performance, guiding algorithmic trading decisions.

Fundamental Analysis

- Fundamental analysis delves into the economic, financial, and qualitative aspects of trading assets.

- Algo traders incorporate elements like earnings reports, economic indicators, and news sentiment analysis.

- Earnings reports can trigger buy or sell decisions based on surprises, while economic indicators can guide algorithms in response to data releases affecting market sentiment.

- Algorithms can also harness natural language processing to gauge news sentiment and adapt trading strategies accordingly.

Sentiment Analysis

- Sentiment analysis focuses on evaluating market sentiment and investor emotions.

- Algorithms can incorporate social media monitoring to assess sentiment derived from keywords and discussions on platforms like Twitter and Reddit.

- News sentiment analysis is another avenue where algorithms can assess the tone of news articles and base trading decisions on sentiment data.

- Additionally, option flow analysis can offer insights into market expectations by tracking unusual options activity.

- These sentiment analysis methods add an emotional dimension to trading decisions, enabling algorithms to react to market sentiment shifts.

Risk Management Parameters

- Effective risk management is the backbone of algorithmic trading to safeguard capital. Hence, platforms like uTrade Algos provide comprehensive risk assessment analysis reports.

- Stop-loss orders act as safety nets by defining exit points for losing positions.

- Take-profit levels help lock in profits at predefined points, ensuring gains aren’t eroded.

- Position sizing is critical, determining how much capital is allocated to each trade based on risk tolerance.

- Leveraging controls limits exposure to risky situations.

- Portfolio diversification ensures risk is spread across various assets, reducing the impact of a single losing trade on the overall portfolio.

- Careful calibration of these risk management parameters is vital for algorithmic trading success.

Step 6: Backtest Your Strategy

Before deploying your algorithm in live markets, backtest it using historical data.

- Backtesting involves testing your strategy using historical market data to assess its performance.

- Obtain historical price data for the assets you intend to trade. This data should cover a significant period, including different market conditions and varying levels of volatility.

- Utilise backtesting software or trading platforms that offer backtesting features. Many popular trading platforms come with built-in backtesting capabilities.

- Clearly define the parameters of your trading strategy, including entry and exit conditions, risk management rules, and any technical indicators or filters used.

- Execute your trading algorithm using historical data as if it were real trading, without risking capital. The algorithm will generate signals and execute trades based on the parameters you’ve set.

- Analyse the results of the backtest. Assess factors such as the number of winning and losing trades, the total return on investment (ROI), the maximum drawdown (the largest peak-to-trough decline), and the risk-adjusted returns.

- Slippage is the difference between the expected price of a trade and the actual executed price. In backtesting, it’s essential to simulate slippage as it occurs in real markets, as it can impact the profitability of your strategy.

- In real trading, costs such as spreads, commissions, and fees affect your returns. Include these costs in the backtest to obtain a more accurate picture of how your strategy will perform in live trading.

- Backtesting often reveals strengths and weaknesses in your strategy. Use this feedback to refine your strategy, adjust parameters, or even consider alternative approaches. Backtest the revised strategy to assess improvements.

- Perform backtests on multiple timeframes to ensure your strategy is robust and effective in different market environments, including short-term and long-term scenarios. uTrade Algos is one platform that provides accurate historical data, thus helping traders perform effective backtests.

- Backtesting also helps validate your risk management parameters, such as stop-loss and take-profit levels. Ensure that these safeguards align with your overall risk tolerance and capital allocation strategy.

Step 7: Go Live

When you’re ready for live trading, start with a small amount of capital. This initial phase is a crucial transition as you begin executing real trades in the market. Ensure you closely monitor your algorithm’s performance and be prepared for potential adjustments.

Step 8: Continuous Monitoring and Optimisation

An algorithmic trading program is an ongoing process that requires constant monitoring and optimisation. Keep a watchful eye on your algorithm’s performance, making adjustments as market conditions change. It’s essential to adapt and refine your strategy to maintain its effectiveness over time.

Step 9: Risk Management

Implementing robust risk management techniques is paramount to safeguarding your capital. Set clear stop-loss orders, adhere to position sizing rules, and control leverage to mitigate potential losses. Algo trading can amplify gains, but it also carries risks that must be managed effectively.

By following these detailed steps, you can embark on your algorithmic trading journey with a strong foundation and a better understanding of the intricacies involved in automated trading. Remember that patience, continuous learning, and disciplined execution are key to success in the world of algorithmic trading.

November 6, 2023

November 6, 2023