Quantitative trading, also known as algorithmic trading, has changed financial markets by using mathematical models and data analysis to make trading decisions. For beginners looking to enter this exciting field, understanding the basics of quantitative trading, choosing the right strategies, and utilising the appropriate platforms and software are crucial steps. This guide provides a comprehensive overview to help you embark on your journey into quantitative trading.

Understanding Quantitative Trading

Quantitative trading involves using statistical models and algorithms to identify trading opportunities and execute orders automatically. Unlike traditional trading methods that rely on human judgment, quantitative trading relies on quantitative analysis of market data, historical performance, and other factors to make informed decisions. This approach aims to remove emotional biases and improve consistency in trading strategies.

Key Components of Quantitative Trading

- Data Collection and Analysis: Quantitative traders rely heavily on data. They gather vast amounts of market data, including price movements, trading volumes, and economic indicators. Advanced data analysis techniques, such as statistical analysis and machine learning, help in extracting meaningful insights and developing predictive models.

- Algorithm Development: Algorithms form the backbone of quantitative trading strategies. These algorithms are programmed to execute trades based on predefined criteria, such as price trends, volatility levels, and risk parameters. Developing robust algorithms requires a solid understanding of programming languages like Python, R, or specialised platforms provided by quantitative trading software.

- Risk Management: Effective risk management is critical in quantitative trading. Strategies often include risk control measures such as stop-loss orders, position sizing rules, and portfolio diversification. These measures help in managing downside risk and protecting capital during adverse market conditions.

Choosing Quantitative Trading Strategies

Quantitative trading strategies vary widely based on factors such as market conditions, risk tolerance, and investment goals. Here are some popular strategies used by quantitative traders:

- Statistical Arbitrage: This strategy exploits pricing inefficiencies between related financial instruments based on statistical models.

- Mean Reversion: Mean reversion strategies capitalise on the tendency of asset prices to revert to their historical averages after significant movements. Algorithms identify overbought or oversold conditions and execute trades to capture potential price corrections.

- Trend Following: Trend following algorithms analyse trend indicators, such as moving averages or momentum oscillators, to identify and capitalise on trends.

- Machine Learning-Based Strategies: Advanced quantitative traders incorporate machine learning algorithms to analyse large datasets and identify complex patterns that may not be apparent through traditional analysis methods. These strategies continuously adapt to changing market conditions and optimise trading decisions based on real-time data.

Quantitative Trading Platforms and Software

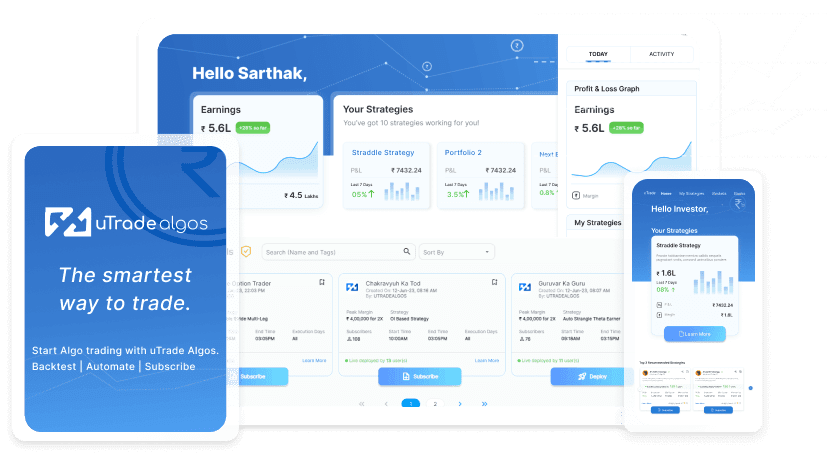

Choosing the right quantitative trading platform and software is essential for implementing and executing trading strategies effectively. These platforms, like uTrade Algos, provide tools for data analysis, algorithm development, backtesting, and execution. They also offer customisable solutions tailored to the needs of quantitative traders, allowing them to test strategies in simulated environments before deploying them in live markets.

Steps to Get Started with Quantitative Trading

- Education and Skill Development: Begin by learning the fundamentals of quantitative trading, including statistics, programming languages, and financial markets. Online courses, books, and tutorials can provide valuable insights and practical knowledge.

- Selecting a Quantitative Trading Platform: Choose a quantitative trading platform that aligns with your trading objectives and technical proficiency. Consider factors such as data availability, backtesting capabilities, and integration with brokerage services.

- Developing and Testing Strategies: Use historical data to develop and backtest quantitative trading strategies. Evaluate the performance of strategies based on metrics like risk-adjusted returns, and drawdowns. Refine algorithms and parameters based on testing results.

- Deploying Strategies in Live Markets: Once satisfied with the performance during backtesting, deploy strategies in live markets with caution. Monitor performance metrics closely and make necessary adjustments to optimise trading strategies over time.

Embarking on the journey of quantitative trading requires a blend of analytical skills, programming proficiency, and market understanding. By understanding the fundamentals of quantitative trading, choosing appropriate strategies, and leveraging advanced platforms like uTrade Algos, beginners can build robust trading systems that enhance decision-making in dynamic financial markets. Start your journey today and explore the transformative potential of quantitative trading in shaping your financial future.

July 23, 2024

July 23, 2024