Quantitative trading has altered financial markets by leveraging advanced mathematical models and data analysis to make trading decisions. At the heart of successful quantitative trading strategies lies backtesting—an essential process that evaluates the performance of trading algorithms using historical market data. This comprehensive guide explores the critical role of backtesting in quantitative trading, its benefits, methodologies, best practices, and the pivotal role of quantitative trading platforms and software.

Understanding Backtesting in Quantitative Trading

Backtesting is the systematic process of applying a trading strategy to historical market data to evaluate its performance. It serves as a simulation tool to assess how a strategy would have performed in the past under different market conditions. By backtesting, traders can validate the effectiveness of their algorithms, identify potential weaknesses, and refine strategies before deploying them in live trading environments. This process is fundamental in minimising risks and optimising trading strategies.

Benefits of Backtesting

- Performance Evaluation: Backtesting provides quantitative metrics, such as risk-adjusted returns, and drawdowns, to evaluate the performance of trading strategies over historical data. This analysis helps traders understand their performance under various market conditions.

- Risk Assessment: Backtesting allows traders to assess the risk associated with a strategy by analysing metrics such as maximum drawdown, volatility, and Sharpe ratio. Understanding these risk metrics helps traders implement effective risk management techniques and adjust strategy parameters to mitigate potential losses.

- Strategy Optimisation: Through iterative backtesting, traders can fine-tune strategy parameters, including entry and exit rules, position sizing, and risk controls. Optimisation aims to improve strategy performance and adapt strategies to changing market dynamics.

- Behavioural Analysis: Backtesting provides insights into the behavioural aspects of a trading strategy, such as its response to market events and its consistency in achieving performance objectives. This analysis helps traders build confidence in their strategies and make informed decisions during live trading.

Methodologies of Backtesting

- Data Selection: Selecting high-quality historical data that accurately reflects market conditions during the backtesting period is crucial. The data should include relevant factors influencing trading decisions, such as economic events, market sentiment, and liquidity conditions.

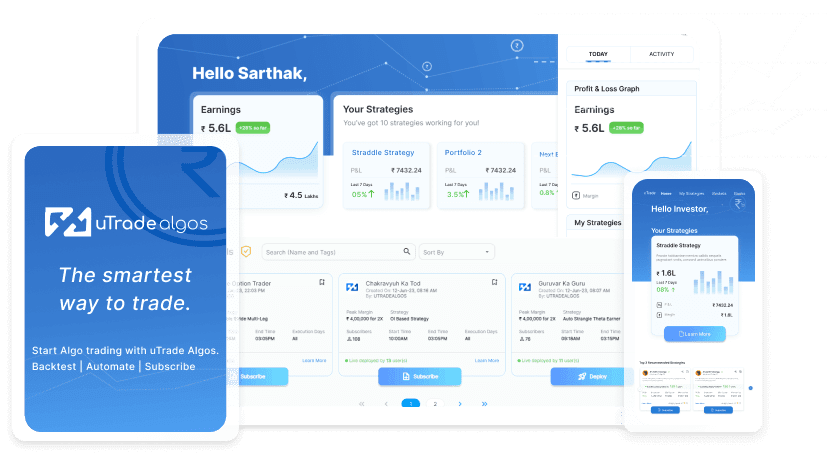

- Strategy Implementation: Implement the trading strategy using quantitative trading software or platforms like uTrade Algos. Define clear entry and exit criteria, risk management rules, and performance metrics to evaluate strategy effectiveness objectively.

- Performance Metrics: Define key performance metrics, including risk metrics (e.g., maximum drawdown, volatility), and statistical indicators (e.g., win rate, average trade duration). These metrics provide a comprehensive evaluation of strategy performance and guide decision-making processes.

- Scenario Testing: Conduct scenario analysis to evaluate strategy robustness under different market conditions, such as bull and bear markets, high volatility periods, and geopolitical events. Scenario testing helps assess strategy adaptability and resilience to adverse market scenarios.

Best Practices in Backtesting

- Use Adequate Data: Ensure the backtesting period covers a diverse range of market conditions and includes sufficient data points to generate reliable results. Historical data should be free from biases and accurately represent real-world trading environments.

- Account for Transaction Costs: Incorporate transaction costs, slippage, and other trading fees into the backtesting simulation to simulate real-world trading conditions accurately. Accounting for transaction costs ensures that backtesting results are realistic and align with actual trading outcomes.

- Regular Review and Refinement: Continuously review and refine trading strategies based on backtesting results, market feedback, and evolving economic conditions. Regular refinement helps traders adapt strategies to changing market dynamics and improve overall performance over time.

The Role of Quantitative Trading Platforms and Software

Quantitative trading platforms and software play a pivotal role in facilitating efficient backtesting processes and strategy development. These platforms offer advanced tools for data analysis, algorithmic development, backtesting, and execution. Platforms like uTrade Algos provide traders with customisable solutions tailored to their specific trading objectives, enabling them to test and optimise strategies rigorously before deploying them in live markets.

Real-world Applications and Case Studies

Institutional investors, hedge funds, and proprietary trading firms extensively utilise backtesting to enhance quantitative trading strategies. For example, hedge funds employ sophisticated algorithms to hedge positions and manage portfolio risk across diverse asset classes. These algorithms undergo rigorous backtesting to validate their effectiveness and optimise performance parameters before deployment.

In conclusion, backtesting is a cornerstone of quantitative trading, empowering traders to develop, refine, and optimise trading strategies with confidence and precision. By rigorously evaluating strategies using historical data, traders can mitigate risks and make informed decisions in dynamic financial markets. Embracing best practices and leveraging quantitative trading platforms like uTrade Algos enable traders to navigate market complexities effectively and achieve sustainable success in quantitative trading.

Begin your journey into quantitative trading today by harnessing the power of backtesting to unlock the full potential of your trading strategies and capitalise on opportunities in global financial markets.

July 24, 2024

July 24, 2024