Algorithmic trading, often known as algo trading, has changed the financial markets by using computer algorithms to execute trading decisions at speeds and frequencies that human traders cannot match. A critical component of this revolution is backtesting, a process that allows traders to test their algorithms on historical data before deploying them in live markets. This relationship between backtesting and algorithmic trading is fundamental to the reliability of trading strategies.

Understanding Backtesting in Trading

Backtesting trading involves simulating a trading strategy using historical market data to evaluate its effectiveness. This process helps traders understand how their strategy would have performed in the past, which can offer insights into its potential future performance. A robust backtesting platform in India, and across the world, enables traders to input their algorithms and run them against historical data, providing a detailed analysis of the strategy’s performance metrics.

For instance, a trader using a backtesting platform in India can input an algo trading strategy that buys stocks based on specific technical indicators. By running this strategy on historical data, the trader can see how often the strategy would have resulted in successful trades, how it would have reacted to market conditions, and what adjustments might be needed.

Role of Backtesting in Algorithmic Trading

Backtesting is essential in algo trading because it provides a risk-free environment to test and refine trading strategies. Without backtesting, traders would have to rely on theoretical assumptions or deploy untested algorithms directly into live markets, which can be risky. By using a backtesting platform, traders can identify flaws and optimise their strategies before risking actual capital.

Algo trading backtesting allows traders to assess the robustness of their strategies across various market conditions. For example, an algorithm might perform well during a bullish market but fail during a bearish or volatile market. Backtesting enables traders to identify these weaknesses and make necessary adjustments.

Moreover, backtesting algorithmic trading involves simulating not just the trading logic but also the operational aspects such as transaction costs, slippage, and latency. These factors can significantly impact the effectiveness of a strategy. An algo trading platform that provides comprehensive backtesting trading tools will account for these elements, giving traders a more accurate picture of their strategy’s performance.

Importance of a Reliable Backtesting Platform

A reliable backtesting platform is crucial for traders who want to implement algorithmic trading strategies. Such platforms offer the computational power and data accuracy needed to run extensive backtests. They provide detailed analytics and performance reports, enabling traders to fine-tune their strategies effectively.

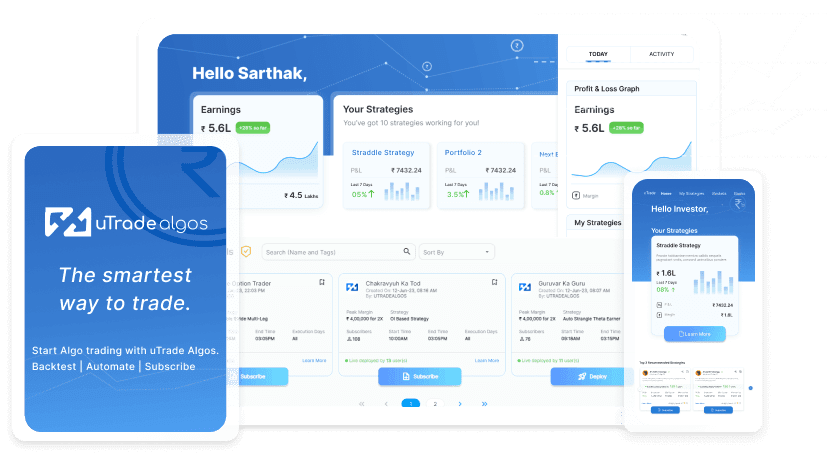

For example, algo trading platforms like uTrade Algos offer advanced backtesting features that allow traders to simulate their strategies in various market conditions and time frames. These platforms support complex algorithms and provide the necessary tools to evaluate performance comprehensively.

In India, the demand for sophisticated backtesting platforms is growing as more traders and firms adopt algorithmic trading. A backtesting platform in India must accommodate the unique characteristics of Indian markets, such as trading hours, liquidity patterns, and regulatory requirements. Platforms cater to these needs by offering localised data and tailored backtesting capabilities.

Algorithmic Trading Platforms and Backtesting

The integration of backtesting capabilities in algorithmic trading platforms is a game-changer for traders. These platforms offer a seamless transition from strategy development to live trading. Traders can develop their algorithms, test them rigorously using backtesting, and deploy them in live markets, all within a single environment.

Algorithmic trading platforms that include backtesting tools allow for iterative development and optimisation. Traders can continually refine their strategies based on backtesting results, ensuring that their algorithms remain effective under changing market conditions. For instance, if a backtest reveals that a particular strategy underperforms during high volatility, the trader can modify the algorithm and test the changes before live deployment.

Platforms like uTrade Algos exemplify the synergy between backtesting trading and live trading. They offer a unified environment where traders can design, test, and execute their strategies with confidence. This integration reduces the risk of discrepancies between backtested results and live performance, providing a more reliable trading experience.

Algo Trading in India and the Need for Backtesting

Algo trading in India is gaining traction as more traders recognise the benefits of automated and high-frequency trading. However, the success of algo trading in India hinges on the ability to test and validate strategies before live trading. Backtesting provides this validation, enabling traders to navigate the complexities of Indian markets effectively.

Indian markets have their unique dynamics, such as varying liquidity levels and regulatory constraints. A backtesting platform in India must consider these factors to provide accurate and relevant results. By using platforms like uTrade Algos, Indian traders can ensure that their algorithms are well-suited to local market conditions.

Moreover, backtesting helps Indian traders understand the impact of transaction costs and other market frictions that are specific to the Indian market. This understanding is crucial for developing strategies that are not only theoretically sound but also practically viable.

In conclusion, the relationship between backtesting and algorithmic trading is integral to the development and success of trading strategies. Algo trading backtesting ensures that strategies are resilient across different market conditions and operational factors. In India, the need for specialised backtesting platforms is evident as more traders adopt algorithmic trading. The synergy between backtesting and algorithmic trading platforms, indeed, enhances the reliability and effectiveness of trading strategies, making it a cornerstone of modern trading practices.

July 14, 2024

July 14, 2024