In the dynamic landscape of the Indian financial markets, where volatility and diversity abound, the need for robust tools and platforms to analyse trading strategies is paramount. Backtesting, the process of assessing trading strategies using historical market data, is a cornerstone of successful trading. Originating in the early days of quantitative finance, backtesting, via backtesting platforms, has evolved into a sophisticated method for evaluating trading strategies in various market conditions.

Characteristics of a Great Backtesting Platform In India

Comprehensive Data Coverage

A great algo backtest platform should offer comprehensive data coverage, including historical price data for various asset classes such as equities, derivatives, currencies, and commodities.

- In India, where markets like the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) dominate, access to accurate and up-to-date market data is essential for meaningful analysis.

- Additionally, the platform should provide data on factors like corporate actions, dividends, and stock splits to ensure the accuracy of backtest results.

Accuracy and Reliability

Accuracy and reliability are non-negotiable when it comes to algo backtesting platforms.

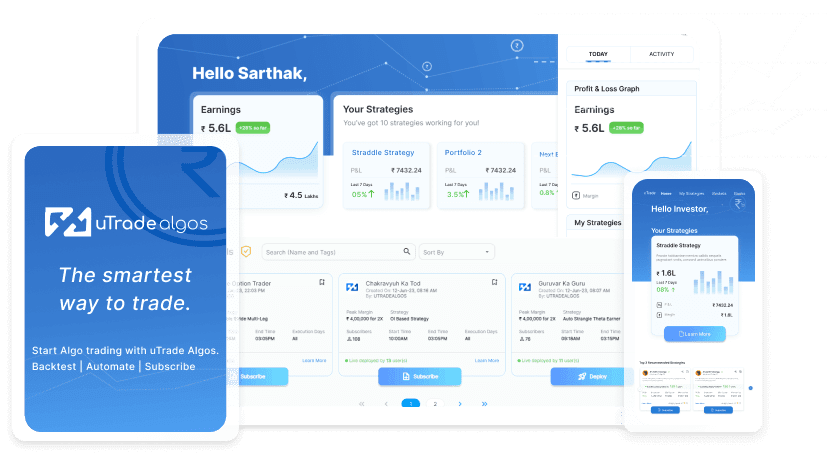

- Platforms, like uTrade Algos, provides clean and error-free data, free from glitches or inaccuracies that could skew results.

- In the Indian context, where market conditions can be volatile and fast-paced, having a platform that delivers accurate data is crucial for making informed trading decisions.

- Moreover, the platform should offer data with minimal latency to ensure that traders have access to real-time information for timely analysis.

User-Friendly Interface

A great algo backtesting platform should have a user-friendly interface that allows traders of all skill levels to navigate and utilise its features effectively.

- Intuitive design, customisable dashboards, and easy-to-understand analytics are essential for enhancing user experience and maximising productivity.

- Additionally, the platform should offer features like drag-and-drop functionality, interactive charts, and customisable layouts to cater to the diverse needs and preferences of traders.

Advanced Analytics and Tools

Advanced analytics and tools are key components of a great backtesting platform.

- Features such as technical indicators, charting tools, performance metrics, and strategy optimisation capabilities empower traders to analyse their strategies comprehensively and make data-driven decisions.

- In India, where traders employ a variety of strategies ranging from intraday trading to long-term investing, having access to advanced analytics is crucial for success.

- Moreover, the platform should offer backtesting algorithmic trading tools that allow traders to simulate various scenarios and optimise their strategies for different market conditions.

Cost-Effectiveness

While the quality of features and services is important, cost-effectiveness is also a consideration for traders, especially those operating on a budget.

- A backtesting platform, like uTrade Algos does, should offer competitive pricing plans that provide value for money without compromising on quality or functionality.

- In the Indian market, where traders seek cost-efficient solutions to optimise their trading strategies, affordability is a significant factor in platform selection.

- Moreover, the platform should offer flexible pricing options, such as monthly or annual subscriptions, to cater to the diverse needs and budgets of traders.

Customer Support and Community

Responsive customer support and an active user community are valuable assets of a great backtesting platform.

- Traders should have access to timely assistance and resources to address any issues or queries they may encounter while using the platform.

- Moreover, a vibrant user community fosters knowledge sharing, collaboration, and idea generation, enhancing the overall trading experience for participants.

- The platform should offer multiple support channels, such as email, live chat, and phone support, to ensure that traders can reach out for help whenever needed.

- Additionally, the platform should host online forums, webinars, and workshops to facilitate interaction and collaboration among users.

Integration with Brokerage Platforms

Seamless integration with brokerage platforms is another feature that enhances the functionality of an algo trading backtesting platform. This allows traders to execute trades directly from the backtesting platform, streamlining the trading process and minimising delays.

- In India, where online trading is gaining popularity, integration with brokerage platforms is a valuable addition that enhances convenience and efficiency for traders.

- The platform should support integration with leading brokerage firms in India, offering features like order placement, account synchronisation, and real-time trade execution.

- Moreover, the platform should ensure compatibility with popular trading platforms and software used by brokerage firms to facilitate seamless connectivity and interoperability.

Drawbacks of Backtesting

Despite its benefits, backtesting algorithmic trading has some limitations that traders should be aware of:

- Overfitting: Optimising a trading strategy based on historical data may lead to overfitting, where the strategy performs well on past data but fails to generalise to future market conditions.

- Assumption of Stationarity: Backtesting assumes that market conditions remain stationary over time, which may not always hold true, especially in dynamic and evolving markets like India.

- Transaction Costs and Slippage: Backtesting often overlooks transaction costs and slippage, which can significantly impact the chances of profitability of trading strategies in real-world scenarios.

- Lack of Emotion and Market Psychology: Backtesting does not account for emotions and market psychology, which play a significant role in trading decisions and market movements.

- Data Quality and Survivorship Bias: Poor-quality data and survivorship bias can distort backtest results, leading to inaccurate performance evaluations and flawed trading strategies.

In the rapidly evolving landscape of the Indian financial markets, having access to a reliable algo trading backtesting platform, like uTrade Algos, can make all the difference for traders as it empowers them to analyse their strategies effectively, make informed decisions, and achieve trading success in the dynamic Indian market ecosystem. With the right platform at their disposal, traders can navigate the complexities of the Indian markets with confidence and achieve their trading goals. However, it’s essential to be mindful of the limitations and drawbacks of backtesting platforms in India to ensure that trading strategies are rigorously evaluated and optimised for success.

June 15, 2024

June 15, 2024